The post RBI Monetary Policy: ब्याज दरों में बदलाव नहीं, जानिए बैंक लोन EMI और एफडी रिटर्न पर क्या होगा असर? appeared first on INDblogs.

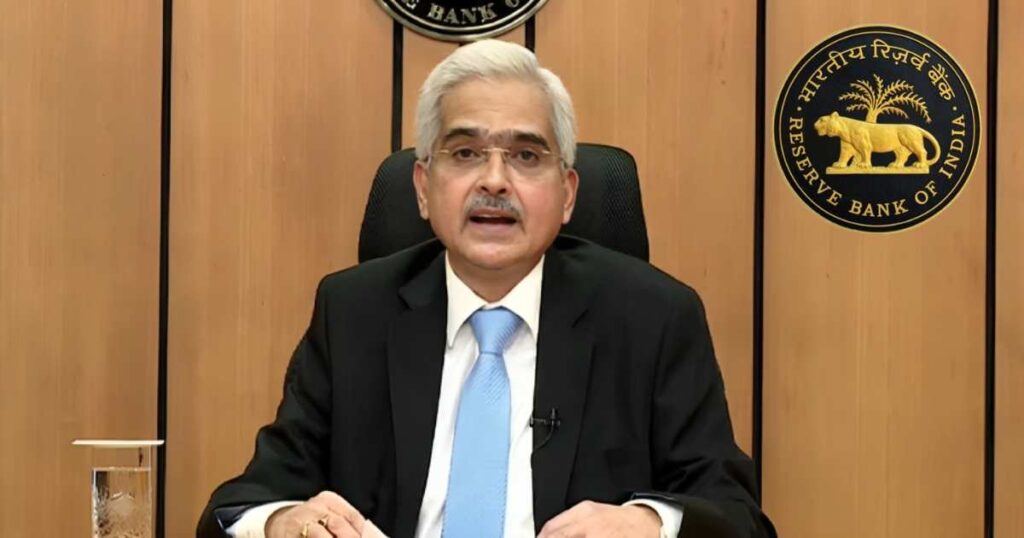

]]>“Uncertainty in food prices continue to impinge on headline inflation. Momentum in domestic activities continues to be strong,” the governor said in the briefing.

Monetary policy must continue to be actively dis-inflationary, Das added. Five out of six members voted in favour of the rate decision

“Global growth is expected to remain steady in 2024, with heterogeneity across regions. Though global trade momentum remains weak, it is exhibiting signs of recovery and is likely to grow faster in 2024. Inflation has softened considerably and is expected to moderate further in 2024,” the central bank governor said.

In its last Monetary Policy Committee (MPC) meeting on December 8, the central bank had kept the repo rate unchanged for the fifth time in a row. Governor Shaktikanta Das had raised the growth projection to 7 per cent for the current financial year from 6.5 per cent earlier.

The monetary police committee is entrusted with the responsibility of deciding the policy repo rate to achieve the inflation target, keeping in mind the objective of growth

The retail inflation in the current financial year has declined after touching a peak of 7.44 per cent in July 2023, it is still high and was 5.69 per cent in December 2023, though within the Reserve Bank’s comfort zone of 4-6 per cent

What RBI governor said last time

Last month, the RBI governor had said that the Indian economy should record a growth rate of 7 per cent in the next financial year and inflation is likely to ease further.

Das had also credited the Centre for structural reforms it undertook in recent years, saying they have boosted the medium and long-term growth prospects of the Indian economy.

“Chances of soft landing have improved and markets have reacted positively. However, geopolitical risks and climate risks remain matters of concern,” the governor had remarked.

During her interim budget address to parliament, finance minister Nirmala Sitharaman had said that India would reduce its budget gap sharply in fiscal year 2024-25 and focus on infrastructure and long-term reforms to drive growth.

The post RBI Monetary Policy: ब्याज दरों में बदलाव नहीं, जानिए बैंक लोन EMI और एफडी रिटर्न पर क्या होगा असर? appeared first on INDblogs.

]]>Delhi Officer Under Scanner After ₹ 41 Crore Land Sold For ₹ 353 Crore Read More »

The post Delhi Officer Under Scanner After ₹ 41 Crore Land Sold For ₹ 353 Crore appeared first on INDblogs.

]]>Delhi Chief Minister Arvind Kejriwal’s office has received a corruption complaint against Chief Secretary Naresh Kumar, and the complaint has been forwarded to Vigilance Minister Atishi.

According to the complaint, Mr Kumar is accused of manipulating a Land Acquisition deal to ensure a profit of ₹ 315 crore to a company linked to another that employs his son. The identity of the complainant – a lawyer, according to some reports – has been kept secret, sources told NDTV.

The Chief Minister’s office has sought a detailed report.

According to The Indian Express, the Delhi Chief Secretary has denied the allegations and the acquaintance of senior executives in the firm that employs his son, or the company linked to it.

Mr Kumar has also pointed out that it was he who had taken action in this case.

The complaint relates to the sale of a 19-acre plot of land in the city’s southwest that was bought in 2018 by the National Highways Authority of India for the construction of the Dwarka Expressway.

The original sale price of ₹ 41.52 crore was decided by the then district administration.

This was raised to ₹ 353.79 crore by Hemant Kumar, the then South West Delhi district magistrate.

Mr Kumar was later suspended and his order set aside.

According to The Indian Express, the complainant has argued the higher price ordered to be paid by the NHAI to one of the landowners was manipulated by the Delhi Chief Secretary.

The landowner who was to receive the higher price – Subhash Chand Kathuria – is directly related to one Aman Sarin, who is the promoter of realty firm Anant Raaj Ltd.

Mr Sarin has alleged links to the Chief Secretary’s son Karan.

According to The Wire, Karan is a Director at another real estate firm – one called Big Town Properties Pvt Ltd, which shares the same postal and email addresses as Anant Raaj Ltd.

According to news agency PTI, in June, this matter was brought to Mr Kumar’s attention. The Chief Secretary directed Delhi’s Directorate of Vigilance – which he heads – to probe the case.

And, in September, with the approval of Delhi Lieutenant Governor VK Saxena, a CBI inquiry and departmental action were recommended against Hemant Kumar – the district magistrate concerned.

Several AAP leaders, including Environment Minister Gopal Rai, Rajya Sabha MP Raghav Chadha and Delhi Minister Saurabh Bhardwaj have commented on this row; Mr Chadha has called it “shocking” and Mr Bhardwaj posted on X, “Last year… serious questions (were raised) about Chief Secretary Mr Naresh Kumar. Now this…”

Post a commentThis latest corruption allegation comes as the AAP is locked in a battle with the BJP, which controls the centre and – thanks to the Delhi Services Bill – transfer of bureaucrats and employees in the city.

The post Delhi Officer Under Scanner After ₹ 41 Crore Land Sold For ₹ 353 Crore appeared first on INDblogs.

]]>Centre Starts Crediting PF Interest: Here’s How To Check Account Balance Read More »

The post Centre Starts Crediting PF Interest: Here’s How To Check Account Balance appeared first on INDblogs.

]]>A few EPFO members have already received the interest amounts. Currently, the interest rate for FY 2022-23 is 8.15%.

Earlier, responding to a query on X (formerly Twitter) about crediting the interest to PF accounts, the provident fund regulatory body said, “The process is in the pipeline and may be shown there very shortly. Whenever the interest will be credited, it will be accumulated and paid in full. There would be no loss of interest. Please maintain patience.”

To check whether the interest has been credited, subscribers can access their passbook online via the EPFO website or UMANG App. The EPFO subscribers can also check their balance through SMS.

How to check EPFO Balance Online

• Visit the employees’ portal of EPFO at https://www.epfindia.gov.in/

• On the homepage, click on ‘Services’ and choose ‘for employees’ from the dropdown list.

• Click on ‘Member Passbook’ link and it will lead to the log in page.

• Login to the account by using your Universal Account Number (UAN), password and captcha.

• You can check your account details and EPF balance.

EPF Balance On UMANG App

-Open Umang App and log in using your mobile number and OTP or MPIN

-After logging in select EPFO

-Click con view Passbook

-Enter your UAN and click on get OTP

-Enter the OTP

-You can see your EPF account details; select the member ID and download the e-passbook.

Check EPFO Balance Through SMS

You can also check EPFO Balance through SMS using your UAN. Send “EPFOHO UAN ENG״ to 7738299899 from your registered mobile number to receive the account balance details in English. The service is now available in English, Hindi, Punjabi, Gujarati, Marathi, Kannada, Telugu, Tamil, Malayalam and Bengali.

The post Centre Starts Crediting PF Interest: Here’s How To Check Account Balance appeared first on INDblogs.

]]>Bank Of Baroda World App Mess Began With An Innocuous Reward Read More »

The post Bank Of Baroda World App Mess Began With An Innocuous Reward appeared first on INDblogs.

]]>What started as an innocuous celebration of daily activation targets soon turned into a heaping mess of operational issues, fraudulent manipulation of technical loopholes to win further incentives and a war of words between the senior management at the bank.

On Saturday, BoB’s Managing Director and Chief Executive Officer Debadatta Chand surprised reporters on a conference call by openly calling out the lender’s former Chief Digital Officer Akhil Handa.

When reporters quizzed Chand on Handa’s sudden exit on Nov. 1 even as the bank was dealing with the aftermath of regulatory censure, he said that the exit was a termination of services. Chand also said this was part of a series of administrative actions taken by the bank in the BoB World app case as it found irregularities.

This was the exact opposite of Handa’s claim that he resigned on his own as part of a long-planned exit.

Once the story came out, Handa quickly reached out to BQ Prime to confirm that he had indeed resigned, sharing a screenshot of his one-line resignation letter as proof. BQ Prime is not revealing the screenshot as the reason for his resignation is not clarified in the letter. Handa also shared the same message with reporters from other news organisations the same evening.

“My exit was a personal decision that I conveyed to the top management in August and since then I had been serving my notice period. The narrative of termination seems a deflection of operational lapses at the branch level issues (sic),” Handa said in a separate statement on Saturday.

So, who is in the right here?

A leaky app with poor security, employees and third-party workers gaming the system to earn incentives, both played crucial parts in this case, according to four people with direct knowledge of the matter who spoke on the condition of anonymity.

It’s not possible to do something like this unless there is a loophole in the app, according to a senior cybersecurity expert who works with banks regularly and who didn’t want to identified out of business concerns.

The App At Fault

On July 11, Al Jazeera reported an expose alleging that BoB employees were inflating registration numbers on the BoB World app by fraudulently linking phone numbers to some bank accounts. The following day, the lender denied that its officials were engaged in any such activities.

“The bank has a current mobile banking activated user base of 30 million customers, all of whom are linked to a unique mobile number seeded with their bank account,” the bank had said.

According to data shared by the bank in its investor presentation for the quarter ended March 2023, the BoB World app was downloaded 53 million times and there were 30 million active users. There were over 4 million daily active users performing over 8 million transactions every day.

But within two weeks, on July 26, the lender issued an internal circular highlighting fraudulent financial transactions taking place on the app as users were sharing their credentials with others. The dynamic one-time passwords shared on email were being leaked, leading to fraudulent transactions.

The circular, issued by the digital group at the bank’s headquarters in Bandra Kurla Complex, stated that the bank was removing email-based OTPs and focusing on SMS only. The circular shows that the lender was internally aware of fraudulent financial transactions. BQ Prime has reviewed a copy of the circular.

According to two BoB officials, who who spoke on condition of anonymity, employees and business correspondents colluded to exploit loopholes in the mobile app’s build. The primary flaw was that the app could let someone register the same mobile number with various bank accounts, according to both these officials.

While business correspondents could use their SIM to connect up to eight accounts in the normal course of business, there were 100-200 activations happening on one phone number, these people said. Ideally, a mobile app should throw up red flags when abnormally high activations happen, the cybersecurity expert quoted above said.

Dhiraj Gupta, co-founder and chief technology officer of mFilterItIt, said that it is important to practice default security guidelines. This means if a user who is already registered from one device shifts to another, then the first device should ideally get de-registered.

“The moment you register from another device, the app would increase the security, ask you more questions to ensure that you are a genuine user, and remove the older devices,” he said. “So, from a safety point of view, the tech team must have missed it.”

Incentives Drove The Fiasco

According to the second person quoted above, certain regional offices announced specific targets for employees and business correspondents for BoB World app activations. On achieving targets at a branch level and regional level, cakes would be cut for daily celebrations. The cost of these cakes would be added to the sundry accounts of the respective branch or regional offices.

But soon, the cake cutting was not enough.

On Feb. 28, the digital group at the bank announced an “ambitious” target of 3 crore BoB World app activations. For this, it approved the “invite and earn instant” feature for customers and business correspondents from March 1 to March 31, 2023. BQ Prime reviewed a copy of this circular as well.

While the staff was not eligible, business correspondents and customers who participated in the scheme could earn up to ₹ 10 per activation.

The rules of the game suggest that business correspondents can’t open an account or onboard a customer on their own, the fourth person quoted above, who runs a business correspondent agency, said.

Business correspondents are only authorised to do documentation, e-KYC and other formalities. They can’t independently register mobile numbers on the app. For that, authorisation needs to come from the branch employee dealing with them, the person said.

The Aftermath

While the RBI’s order to block further onboarding of customers on the BoB World app is still at play, the bank has also been taking internal action.

Handa’s exit, according to the bank’s management, is part of this. Additionally, BQ Prime previously reported that at least nine employees were suspended and others were being investigated.

According to a circular issued on Aug. 25-shared with zonal heads of Ahmedabad, Bareilly, Baroda, Bengaluru, Bhopal, Jaipur, Kolkata, Lucknow, Patna and Rajkot-the bank had identified 362 bank accounts across 68 branches where irregularities were reported. An amount exceeding ₹ 22 lakh was reported to have been debited from these accounts.

Chand, in his address to reporters, had noted that there would be no material impact on the bank’s financials owing to the BoB World app fiasco. That may as well be true. However, the reputational hit would be difficult to quantify.

The post Bank Of Baroda World App Mess Began With An Innocuous Reward appeared first on INDblogs.

]]>Gold Prices Hit ₹ 61,539, Dealers Offer Discounts For Fourth Week!! Read More »

The post Gold Prices Hit ₹ 61,539, Dealers Offer Discounts For Fourth Week!! appeared first on INDblogs.

]]>Local gold prices jumped this week to 61,539 rupees ($739.01) per 10 grams, not far from the all-time high of 61,845 rupees ($742.68) hit in May.

High prices of gold could dampen demand during peak festival season (Reuters)

Physical gold dealers offered discounts for a fourth consecutive week as consumers shied away from making purchases due to higher domestic prices, while top consumer China also saw muted demand.

In India, this week, dealers offered a discount of up to $9 an ounce over official domestic prices – inclusive of the 15% import and 3% sales levies, up from last week’s discount of $5.

“The market was cruising along pretty nicely in the first half of October, but then the price hike came along and threw a wrench in the works. Now, we’re seeing demand lower than usual,” said Amit Modak, CEO at jeweller PN Gadgil and Sons, in the city of Pune.

Local gold prices jumped this week to 61,539 rupees ($739.01) per 10 grams, not far from the all-time high of 61,845 rupees ($742.68) hit in May.

Jewellers have become pessimistic about demand during the upcoming Diwali festival due to the price rise and are hesitant to make purchases, said a Mumbai-based dealer with a private bullion importing bank.

High prices could dampen demand during peak festival season and lead to the lowest purchase volumes in three years, the World Gold Council (WGC) said on Tuesday.

In China, premiums over global spot prices were quoted at $25-$40 per ounce, little changed from last week.

“Despite various easing measures, such as controlling the lease of import quotas, gold imports remain sluggish. The issue lies in the fact that demand is not substantial enough to drive a higher premium,” Bernard Sin, regional director of Greater China at MKS PAMP, said.

In Japan, gold was sold between a discount of $0.25 and a premium of $1 versus last week’s premium of $0.5-$1.

In Hong Kong, bullion was sold at premiums of $1.5-$2.5 per ounce and $1.50-$2.50 in Singapore.

The post Gold Prices Hit ₹ 61,539, Dealers Offer Discounts For Fourth Week!! appeared first on INDblogs.

]]>Top 5 Stock Market Bubbles | History of Biggest 5 stock market crash Read More »

The post Top 5 Stock Market Bubbles | History of Biggest 5 stock market crash appeared first on INDblogs.

]]>1. Tulip Mania : Tulip Mania, a historic market bubble in the Netherlands during the 17th century, saw the price of tulip bulbs skyrocket to irrational heights. Driven by speculative frenzy, people traded tulip bulbs at exorbitant prices, fueled by the perception of immense future profits. The bubble burst in 1637, resulting in a catastrophic collapse of tulip bulb values. The Tulip Mania remains a cautionary tale of irrational exuberance, illustrating how market sentiment can override rational valuation. It serves as a reminder of the dangers of speculative bubbles and the potential consequences of unbridled speculation in financial markets.

2. South Sea Bubble : The South Sea Bubble was a notorious financial bubble that occurred in the early 18th century in England. The South Sea Company, given a monopoly on British trade with South America, promised lucrative returns to investors. As enthusiasm grew, stock prices soared. However, the company’s real value did not match the inflated prices, leading to a massive crash in 1720. Thousands were financially ruined, and the bubble’s collapse had far-reaching economic repercussions. The South Sea Bubble serves as a cautionary tale about the dangers of speculative manias, misleading investments, and the importance of transparent and responsible financial practices.

3. Japan’s Real Estate Bubble : The Japan real estate bubble, also known as the “bubble economy,” emerged during the late 1980s. Fueled by speculative fervor and easy credit, property and stock prices skyrocketed to unsustainable levels. Tokyo’s land became more valuable than all of California. In 1991, the bubble burst, leading to a prolonged period of economic stagnation called the “Lost Decade.” Real estate values plummeted, leaving banks and investors with massive debt. The collapse exposed flaws in Japan’s financial system and underscored the dangers of speculative excess. The Japan real estate bubble remains a cautionary tale about the risks of unchecked speculation and asset price inflation.

4. Dot-com Bubble : The dot-com bubble, a late 1990s economic event, marked an era of rapid internet expansion and speculative investing. Share prices of numerous technology companies, especially those online, surged to unsustainable levels. Investors were captivated by the potential of the digital world, often overlooking traditional metrics like revenue and profits. The bubble burst in 2000, leading to widespread business failures and financial losses. The dot-com bubble’s legacy includes lessons about speculative excess, the importance of sound valuation, and the significance of genuine business fundamentals. It serves as a reminder of how market enthusiasm can lead to inflated expectations and subsequent market crashes.

5. NINJA Mortgage Loans: “NINJA mortgage loans,” standing for “No Income, No Job, No Assets,” were high-risk home loans issued prior to the 2008 financial crisis. Lenders granted these loans without verifying borrowers’ income, employment, or assets. The allure of homeownership led to a surge in such risky lending practices. Many borrowers defaulted when they couldn’t afford payments, contributing to the housing market collapse. NINJA loans epitomized the lax lending standards and reckless behavior that fueled the crisis. They underscore the importance of responsible lending practices and the severe consequences of offering mortgages to individuals without assessing their ability to repay

The post Top 5 Stock Market Bubbles | History of Biggest 5 stock market crash appeared first on INDblogs.

]]>How can I improve my credit score? Read More »

The post How can I improve my credit score? appeared first on INDblogs.

]]>- Check Your Credit Report: Start by obtaining a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion). You can get a free annual report from each bureau at AnnualCreditReport.com. Review your reports for errors, inaccuracies, or fraudulent activity.

- Dispute Errors and Inaccuracies: If you find any errors on your credit report, dispute them with the credit bureaus. Correcting inaccuracies can have an immediate positive impact on your credit score.

- Pay Bills on Time: One of the most significant factors affecting your credit score is your payment history. Pay all your bills on time, including credit card payments, loans, and utility bills. Set up reminders or automatic payments to avoid missing due dates.

- Reduce Credit Card Balances: High credit card balances relative to your credit limits can negatively impact your credit score. Aim to keep your credit card balances below 30% of your credit limit. Paying down balances can have a rapid and positive effect on your score.

- Don’t Close Old Accounts: The length of your credit history is an important factor. Closing old credit card accounts can shorten your credit history, which may lower your score. Keep old accounts open and use them occasionally to maintain a longer credit history.

- Avoid Opening Too Many New Accounts: When you apply for a new credit card or loan, a hard inquiry is made on your credit report. Multiple hard inquiries in a short period can lower your credit score. Be selective about opening new accounts.

- Diversify Your Credit Mix: Having a mix of different types of credit, such as credit cards, instalment loans, and a mortgage, can positively impact your credit score. However, don’t open new credit lines just for the sake of variety; only do so when it’s financially responsible.

- Become an Authorized User: If you have a trusted family member or friend with a good credit history, you can ask to be added as an authorized user on one of their credit card accounts. This can help you benefit from their positive payment history and boost your credit score.

- Pay-Off Collections and Past-Due Accounts: If you have any accounts in collections or past-due accounts, work to pay them off. Settle the debt with the collection agency if possible and ask for a “pay-for-delete” agreement, which can remove the collection from your credit report.

- Use Secured Credit Cards: If you have a low credit score or a limited credit history, consider getting a secured credit card. These cards are backed by a cash deposit, which reduces the risk for the lender and can help you build or rebuild credit.

- Monitor Your Credit Regularly: Keep a close eye on your credit by regularly checking your credit reports and using credit monitoring services. This will help you detect and address any issues promptly.

- Be Patient: Improving your credit score takes time. Be patient and stay consistent with positive credit behaviours. It may take several months or even years to see significant improvements.

- Educate Yourself: Continue to educate yourself about credit management and financial responsibility to make informed decisions and maintain a healthy credit score.

Remember that there is no quick fix for improving your credit score, and it requires responsible financial habits over time. By following these steps and practising good credit management, you can gradually raise your credit score and improve your financial prospects.

The post How can I improve my credit score? appeared first on INDblogs.

]]>How to earn money through Digital Marketing? Read More »

The post How to earn money through Digital Marketing? appeared first on INDblogs.

]]>- Educate Yourself: First, you need to learn the basics of digital marketing. There are many online courses, blogs, and YouTube channels that can help you get started. You can also consider more structured programs like Google’s Digital Garage or HubSpot’s Academy.

- Choose a Niche: Decide on a specific niche or industry you want to focus on. This will help you tailor your marketing efforts and target a specific audience effectively.

- Build a Strong Online Presence:

- Create a Website: Develop a professional website that represents your brand or business. You can use platforms like WordPress, Wix, or Squarespace for this purpose.

- Social Media Profiles: Establish a presence on major social media platforms such as Facebook, Instagram, Twitter, and LinkedIn. Make sure your profiles are complete and engaging.

- Blog: Start a blog on your website to share valuable content and attract visitors.

- Content Marketing:

- Create high-quality content that provides value to your target audience.

- Use SEO techniques to optimize your content for search engines to attract organic traffic.

- Email Marketing:

- Build an email list by offering incentives like ebooks, webinars, or discounts.

- Send out regular newsletters and promotions to engage with your audience.

- Search Engine Optimization (SEO):

- Optimize your website for search engines to improve its visibility in search results.

- Use keywords relevant to your niche and produce quality content.

- Social Media Marketing:

- Post regularly on social media platforms.

- Use paid advertising options to reach a larger audience.

- Paid Advertising:

- Utilize platforms like Google Ads, Facebook Ads, or Instagram Ads to run targeted paid advertising campaigns.

- Set a budget and monitor the performance of your ads.

- Affiliate Marketing: Partner with companies to promote their products or services, earning a commission for each sale or lead generated through your referral.

- Online Courses or Consulting:

- Once you have expertise, you can offer online courses or consulting services in your niche.

- Many people are willing to pay for your knowledge and guidance.

- Freelance Work: Offer your digital marketing services as a freelancer on platforms like Upwork, Freelancer, or Fiverr. This can include services such as SEO, content writing, social media management, and more.

- E-commerce and Dropshipping: If you have or are interested in starting an online store, digital marketing can help drive traffic and sales to your e-commerce site.

- Analytics and Optimization:

- Continuously monitor and analyze your digital marketing efforts.

- Make data-driven decisions and adjust your strategy based on the performance metrics.

- Networking: Build relationships with influencers, other marketers, and potential clients. Networking can lead to collaborations and opportunities.

- Keep Learning: The digital marketing landscape is constantly evolving. Stay up to date with the latest trends and technologies to remain competitive.

Remember that success in digital marketing takes time and effort. It’s important to be patient, persistent, and adaptable to changing trends and algorithms.

The post How to earn money through Digital Marketing? appeared first on INDblogs.

]]>Benefits Of Fixed Deposit Read More »

The post Benefits Of Fixed Deposit appeared first on INDblogs.

]]>- Safety: FDs are one of the safest investment options in India. Your principal amount is protected, and you are guaranteed to receive the promised returns on maturity.

- Assured Returns: FDs offer fixed interest rates, which means you know exactly how much you’ll earn on your investment. This predictability can be advantageous for financial planning.

- Flexible Tenure: You can choose the tenure of your FD, which can range from a few months to several years, depending on your financial goals and needs.

- Liquidity: While FDs are considered as locked-in investments, most banks allow premature withdrawal, though it may come with a penalty. This provides a certain level of liquidity in case of urgent financial requirements.

- Steady Income Stream: Fixed Deposits can be a reliable source of regular income, especially for retirees, as the interest can be paid out at regular intervals (monthly, quarterly, or annually).

- Tax Benefits: Under Section 80C of the Income Tax Act, investments in Tax-saving FDs for a specified tenure are eligible for tax deductions, up to a certain limit.

- Senior Citizen FDs: Special FD schemes for senior citizens often offer higher interest rates, which can be advantageous for those in their retirement years.

- No Market Risk: Unlike investments in stocks or mutual funds, FDs do not expose you to market risks. Your returns are not dependent on market fluctuations.

- Easy Application: Opening an FD account is a straightforward process, and you can do it through your bank’s branch, online banking, or mobile apps.

- Loan against FD: In times of need, you can avail a loan against your FD, typically up to 90% of the deposit amount, with relatively low interest rates.

- Wide Range of Options: Banks offer various types of FDs, such as regular FDs, tax-saving FDs, and special schemes, allowing you to choose the one that suits your financial objectives.

- Cumulative vs. Non-Cumulative: You can choose between cumulative FDs (where interest is compounded and paid at maturity) and non-cumulative FDs (where interest is paid at regular intervals).

- Nomination Facility: You can nominate a beneficiary for your FD, ensuring a smooth transfer of the deposit in the event of your demise.

- Automatic Renewal: Many banks offer automatic renewal options, allowing your FD to roll over for another term if you don’t need the funds immediately.

- Hedge against Inflation: FDs can be a good hedge against inflation, as they provide a stable return that retains its value over time.

While Fixed Deposits offer several advantages, it’s essential to consider your financial goals, risk tolerance, and the prevailing interest rates before choosing this investment option. Additionally, the interest income from FDs is subject to taxation, so it’s important to understand the tax implications and plan your investments accordingly.

The post Benefits Of Fixed Deposit appeared first on INDblogs.

]]>